App Introduction

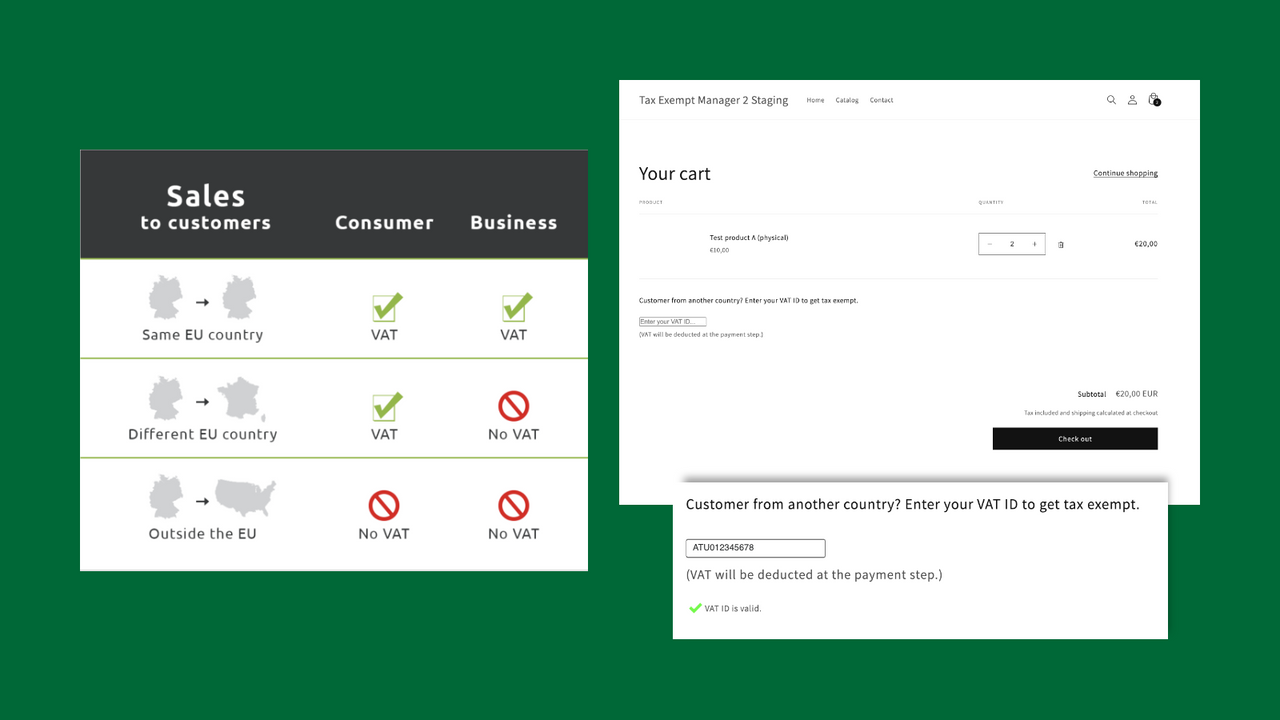

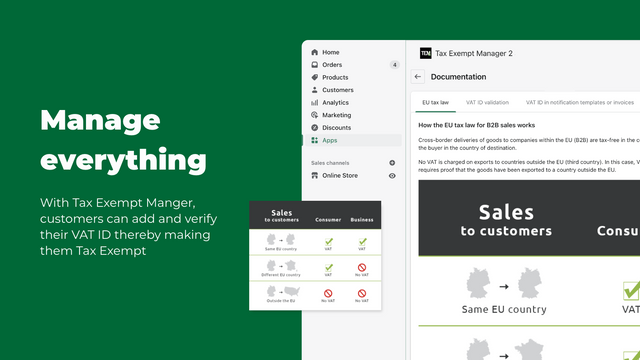

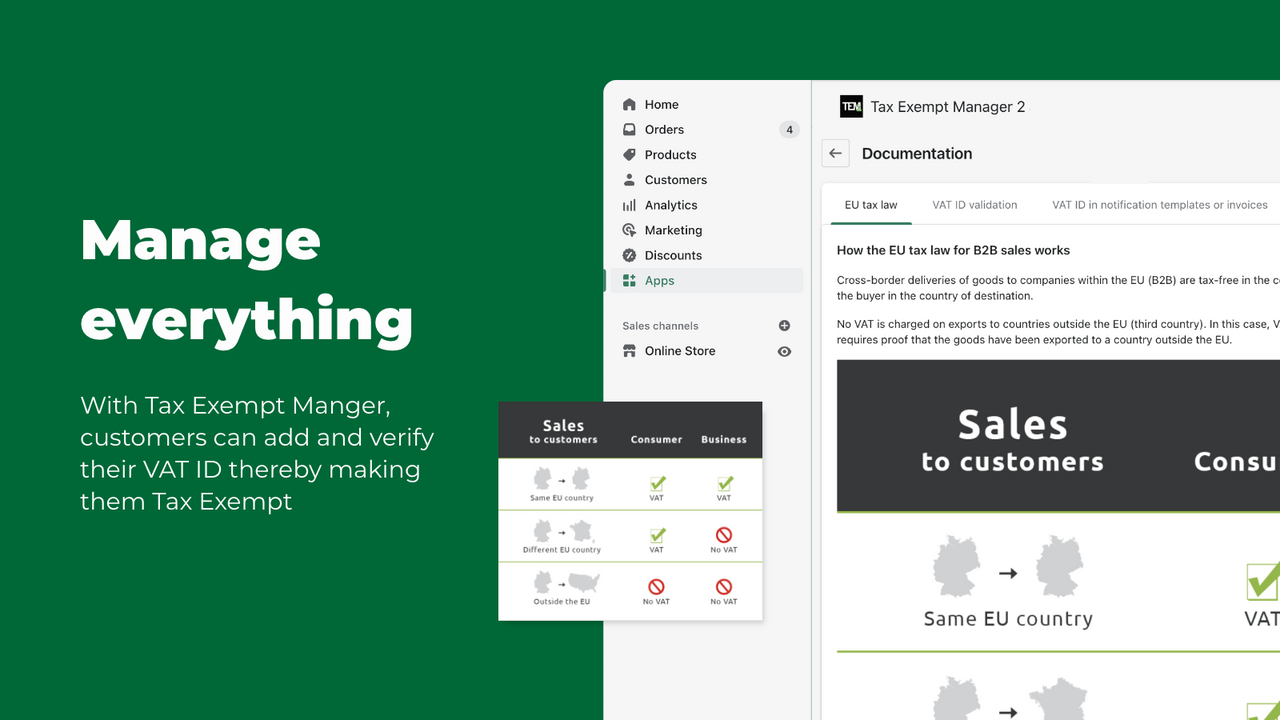

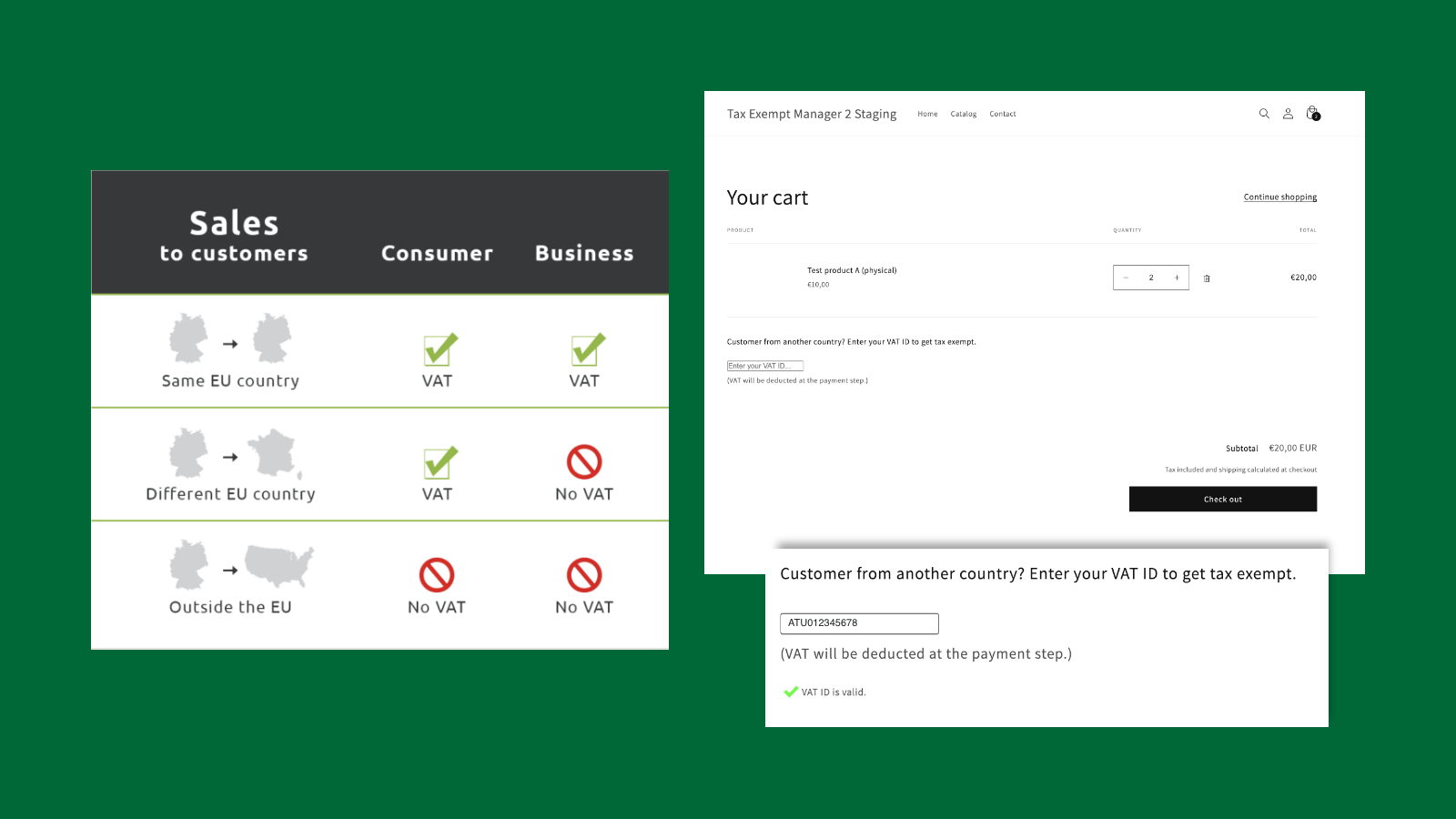

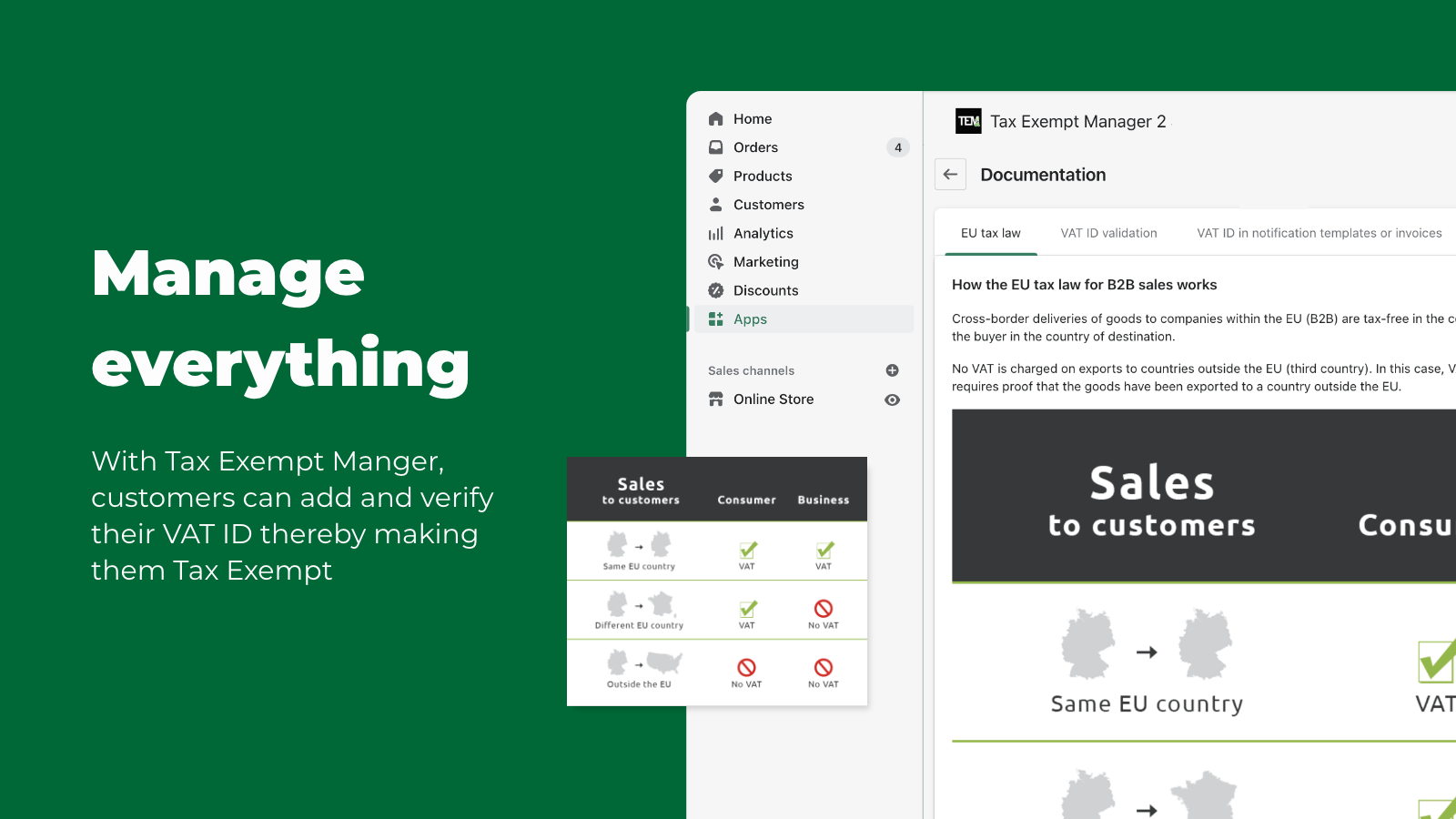

Tax Exempt Manager simplifies sales to your B2B customers while meeting all legal tax requirements! For B2B transactions within the EU, goods delivered cross-border to businesses are exempt from tax in the country of origin, with VAT collected in the buyer’s destination country (reverse charge). For sales outside the EU (third countries), the sale is tax-exempt, but VAT must be paid in the destination country. For non-EU sales, proof of exporting the goods to a third country is also required. Use our Tax Exempt Manager to comply with EU tax regulations when selling to B2B customers!

Core Functionality

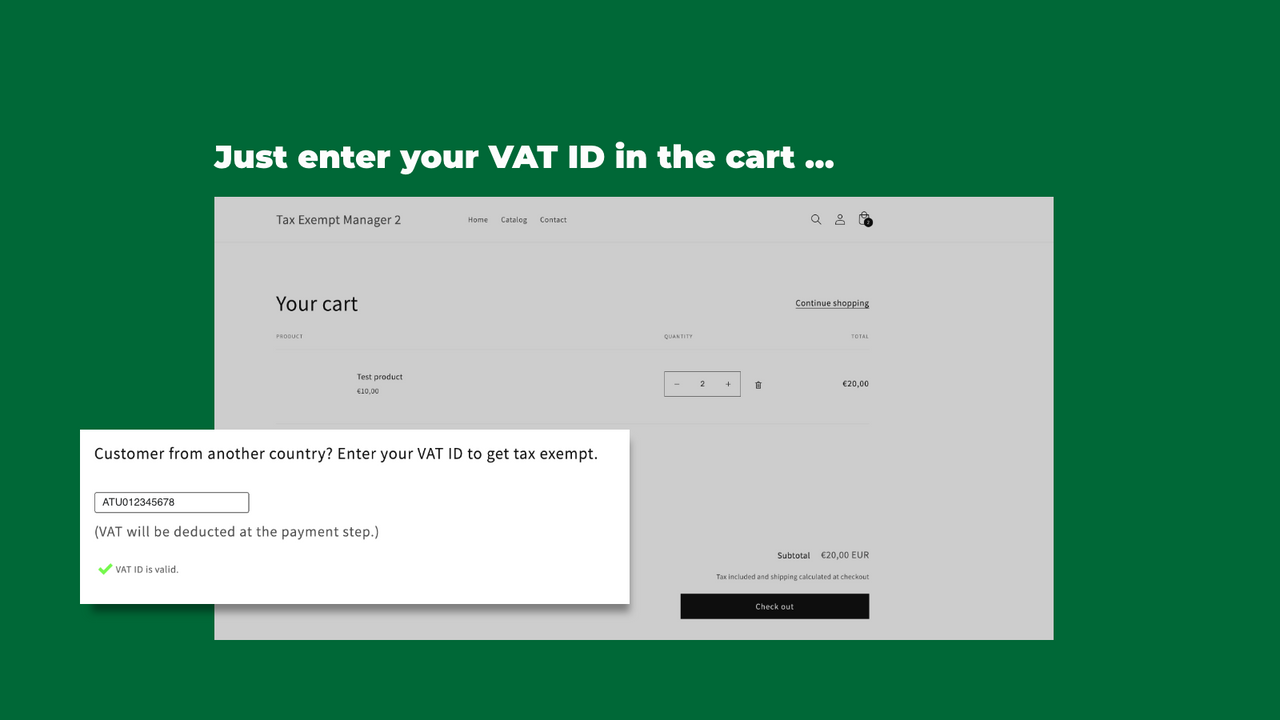

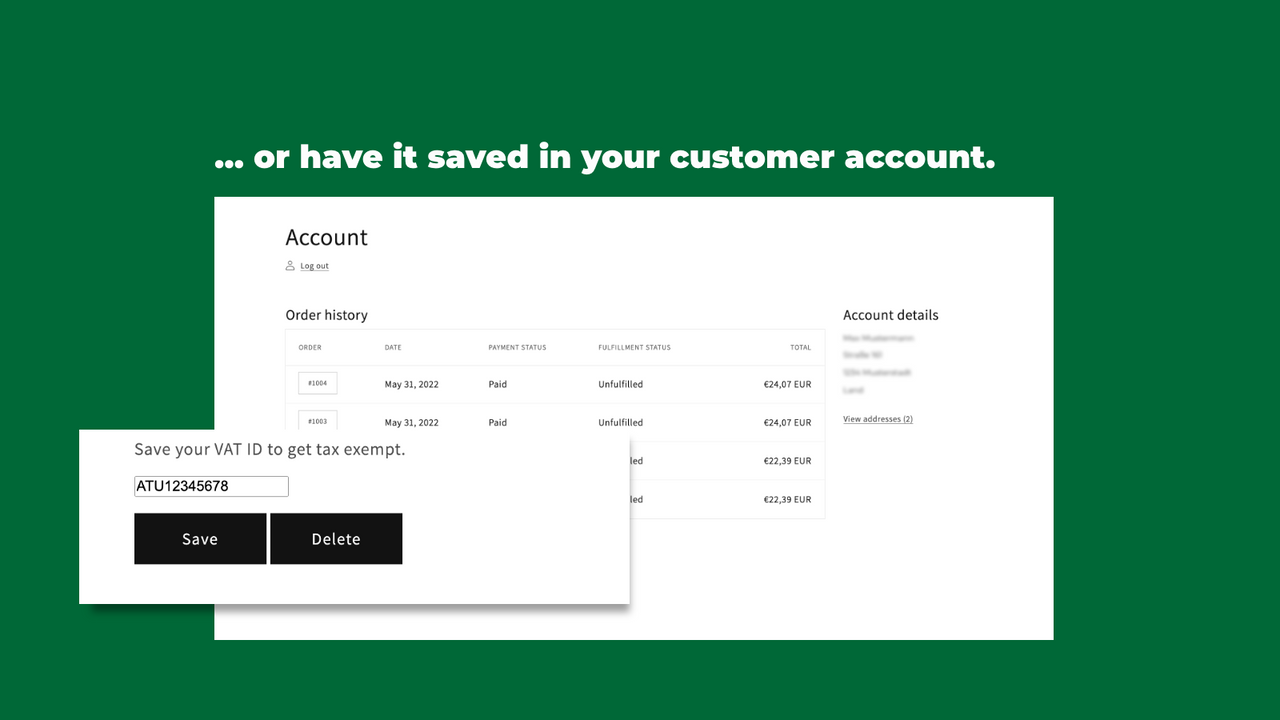

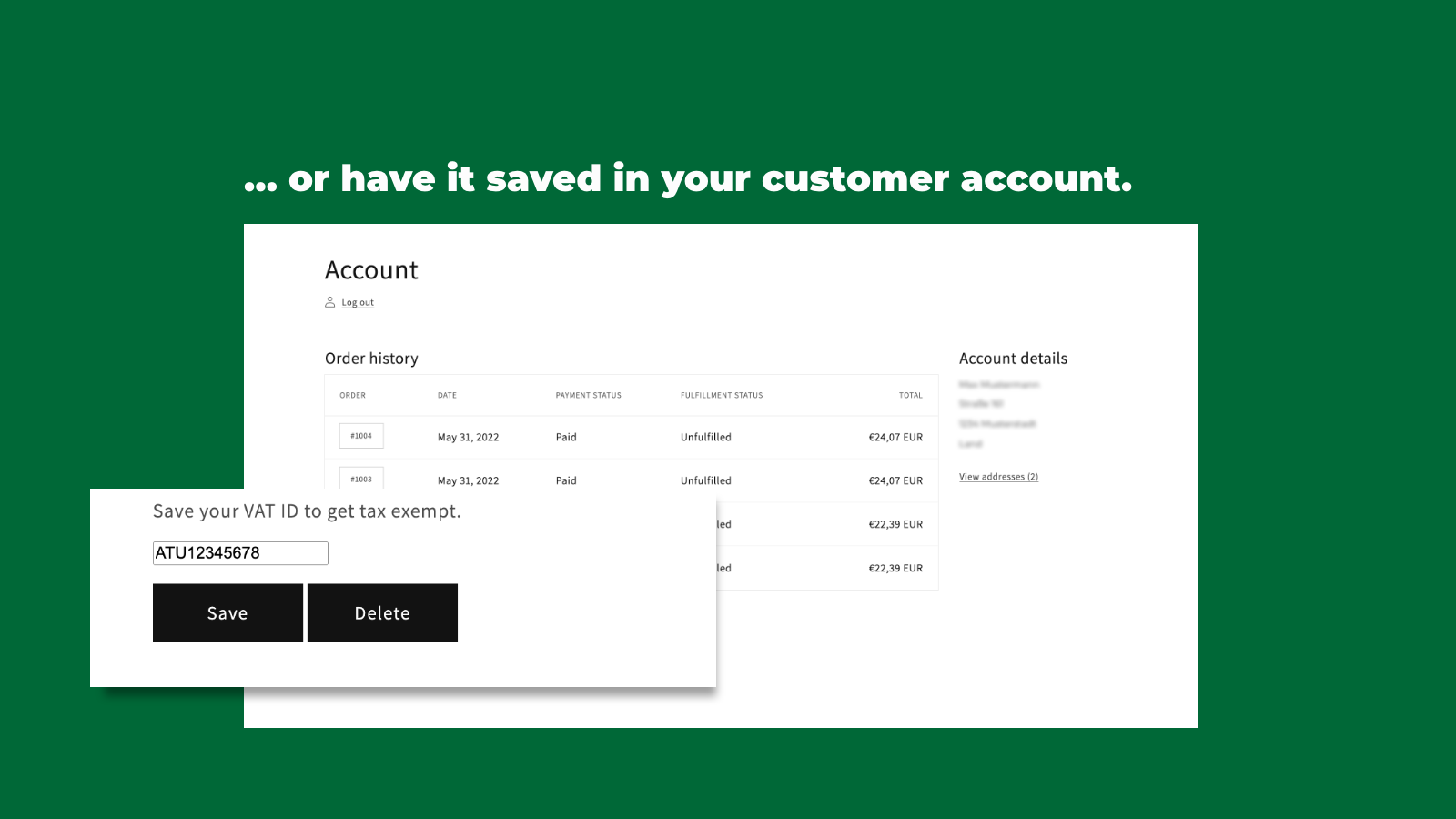

- Tax Exempt Manager allows you to automatically deduct VAT IDs for your customers

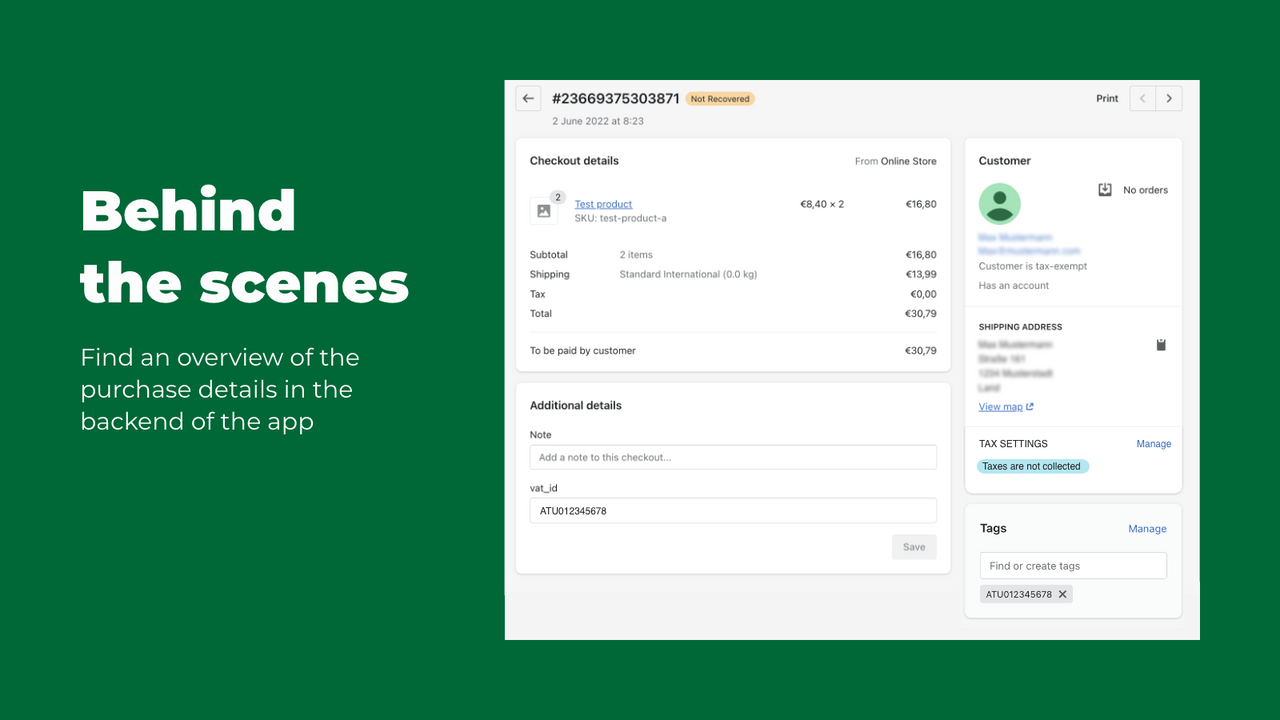

- Display duties, taxes, and fees to your customers upfront, with VAT IDs listed on orders

- VAT numbers are checked via VIES (EU database) and can be printed on invoices

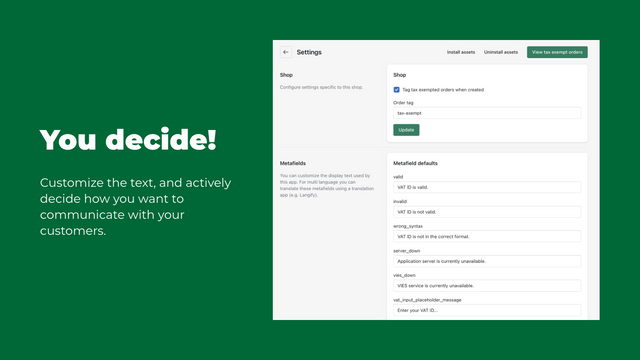

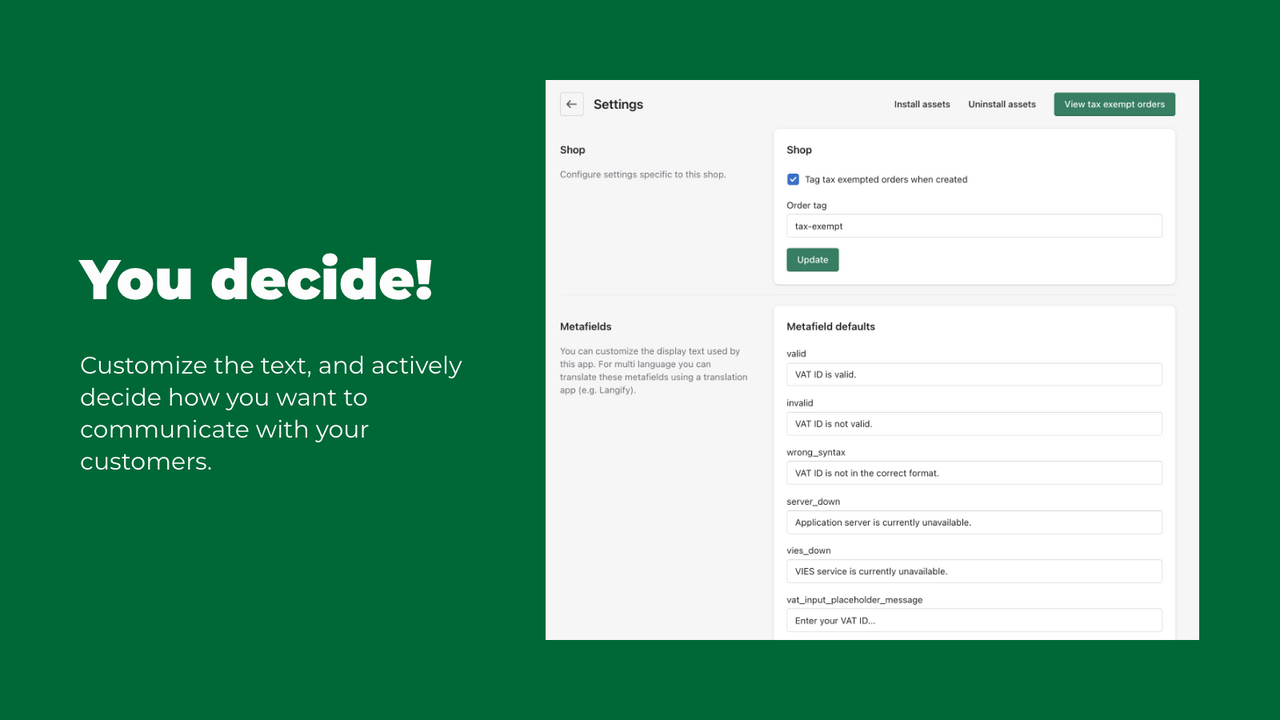

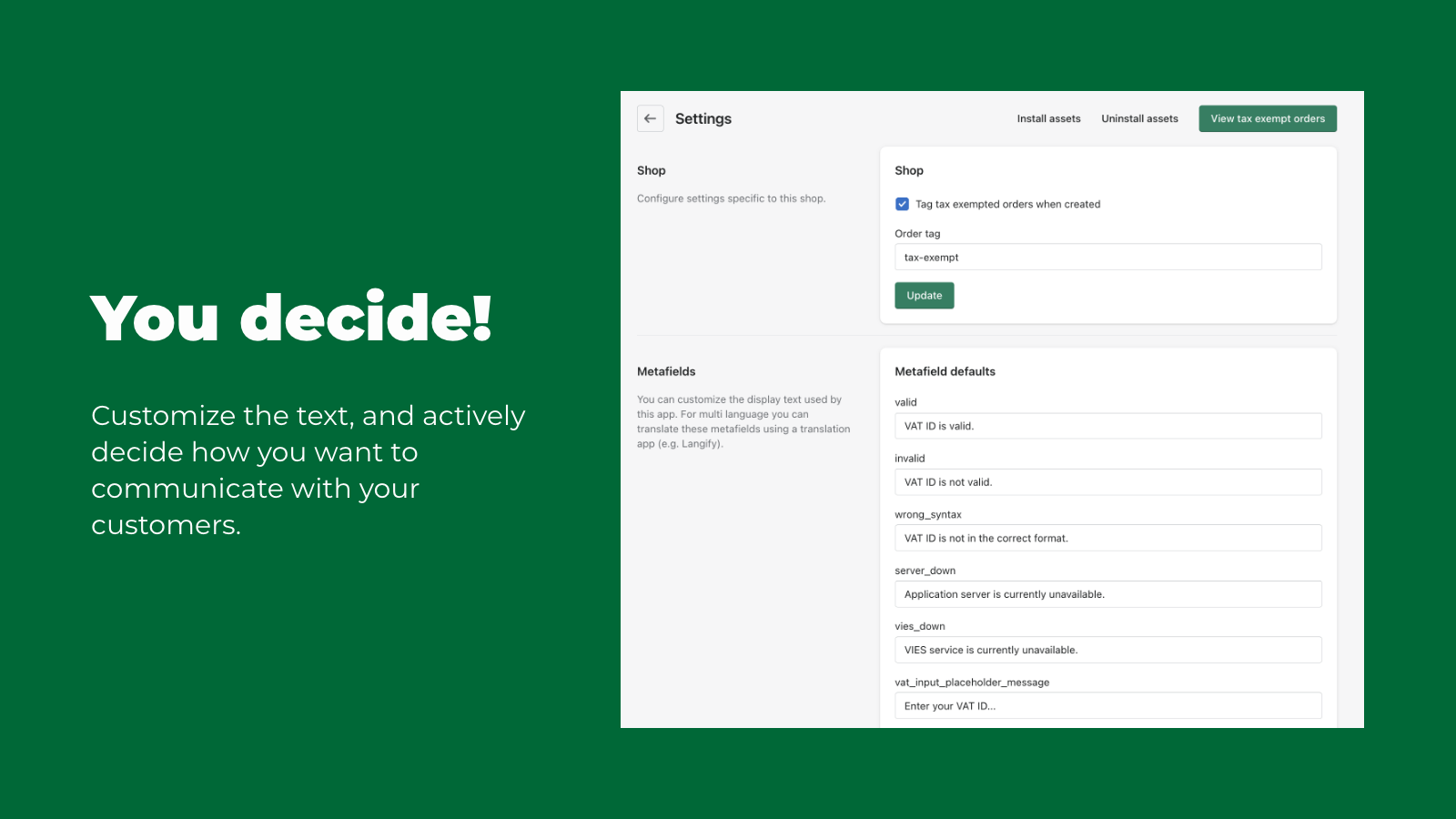

- TEM supports custom order and customer tags, text, and discount codes

- Quickly and easily install the app and integrate marketplaces in your store

Merchant-Friendly

- EU Cross-border E-commerce

- Multi-market Independent Store

- B2B Trade Merchants

- International E-commerce Sellers

Basic Information

- Developer:Latori GmbH

- Address:Sonnborner Str. 39, Wuppertal, 42327, DE

- Price: Free / Free plan

- Rating:3.2 / 5

- Comment Count:25 comment

- Release Date:2018-9-26

- Supported languages:English

- Compatible products:Shopify

Application Screenshot

Price Plan

基础

- Allow your customers to shop tax-free outside the EU if you are located within the EU.

User Location & Comments

User Location

Comments

Shopify API Used

- POST /admin/api/customers/{customer_id}/tax_exemptions.json

- PUT /admin/api/customers/{customer_id}/tax_exemptions/{id}.json

- GET /admin/api/customers/{customer_id}/tax_exemptions.json

Permission:write_customers,read_customers,manage_taxes

- POST /admin/api/orders/{order_id}/taxes.json

- PUT /admin/api/orders/{order_id}/taxes/{tax_id}.json

- GET /admin/api/orders/{order_id}/taxes.json

Permission:write_orders,read_orders,manage_taxes

- POST /admin/api/tax_exemptions/verify.json

- GET /admin/api/tax_exemptions/{id}/verify_status.json

- PUT /admin/api/tax_exemptions/{id}/verified.json

Permission:read_tax_exemptions,write_tax_exemptions,manage_invoices

- POST /admin/api/orders/{order_id}/tags.json

- PUT /admin/api/orders/{order_id}/tags.json

- GET /admin/api/orders/{order_id}/tags.json

Permission:write_orders,read_orders,manage_discounts

- POST /admin/api/apps/install.json

- GET /admin/api/apps/{app_id}/integration_status.json

- PUT /admin/api/apps/{app_id}/integration_config.json

Permission:write_shop,read_shop,manage_apps