App Introduction

Regulo is the only invoicing app compliant with French and European regulations Regulo generates invoices for your orders and separate credit notes for your product returns, applying the corresponding VAT rates. Easy to use, Regulo lets you automate invoicing so you can keep running your business tax-risk-free, without interruptions, and in full compliance with French and European authorities. Regulo also enables you to export accounting files (FEC) for your sales—these are integrable into accounting systems in 2 clicks, with no manual processing required.

Core Functionality

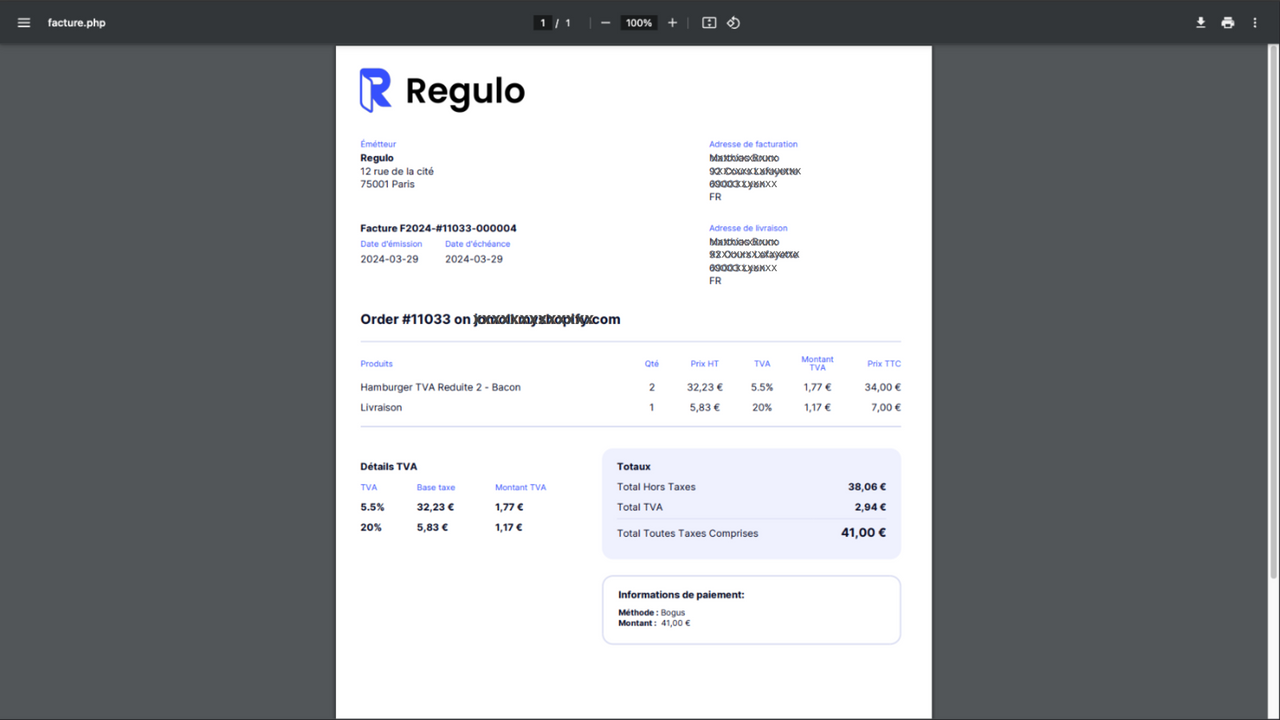

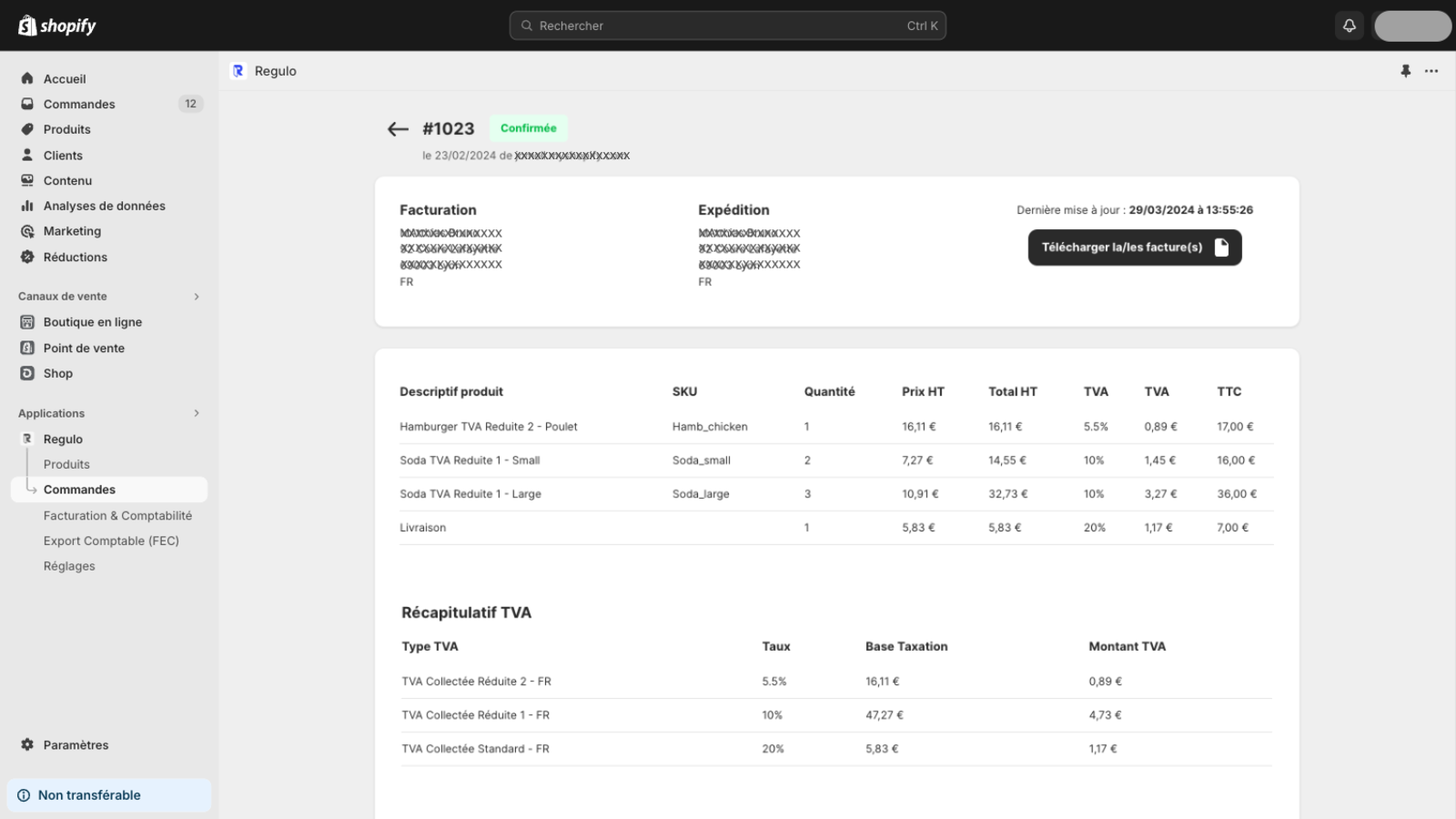

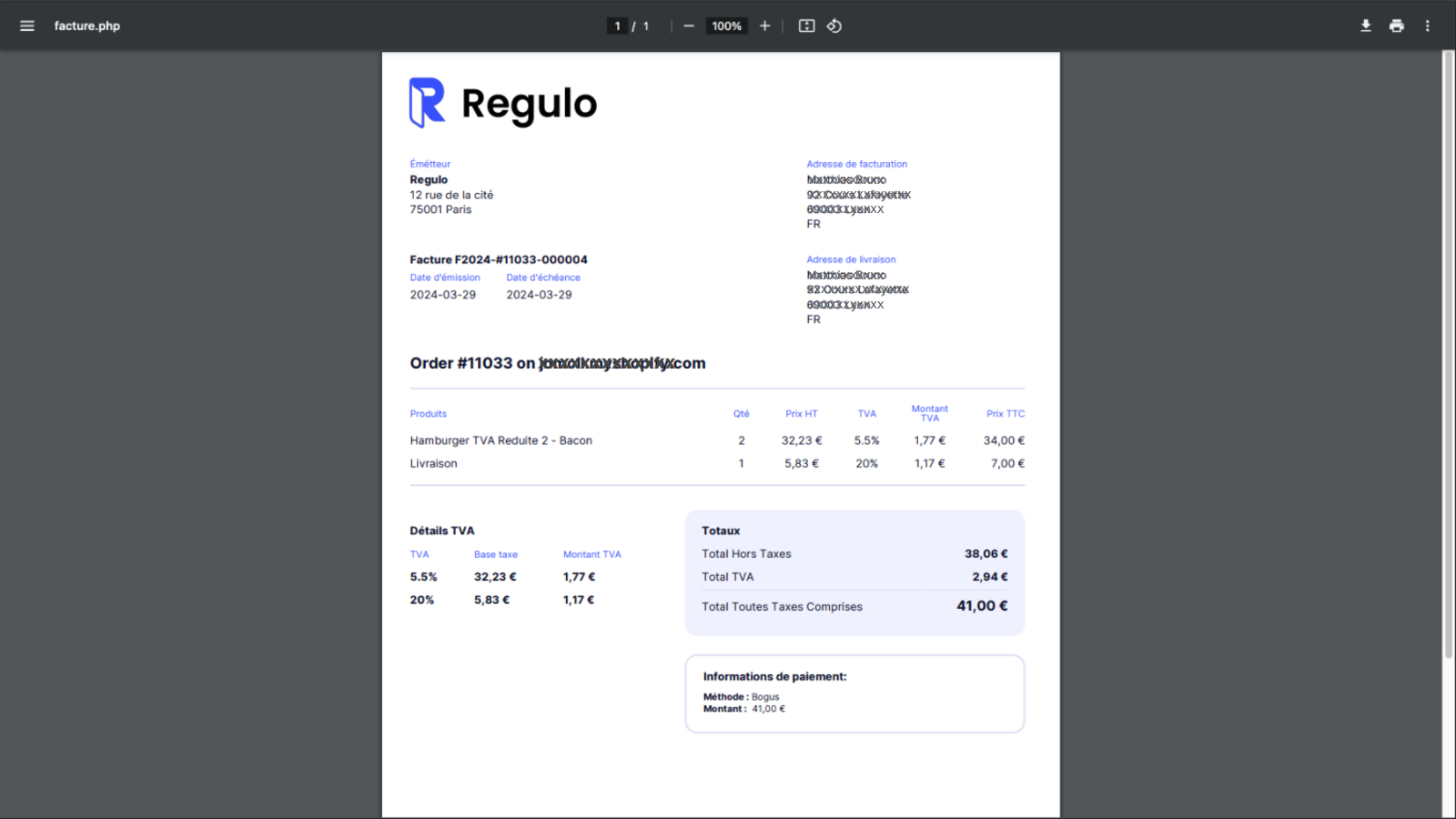

- Automated generation of invoices and credit notes (refunds/exchanges)

- Regulo tracks all different reduced and European VAT rates

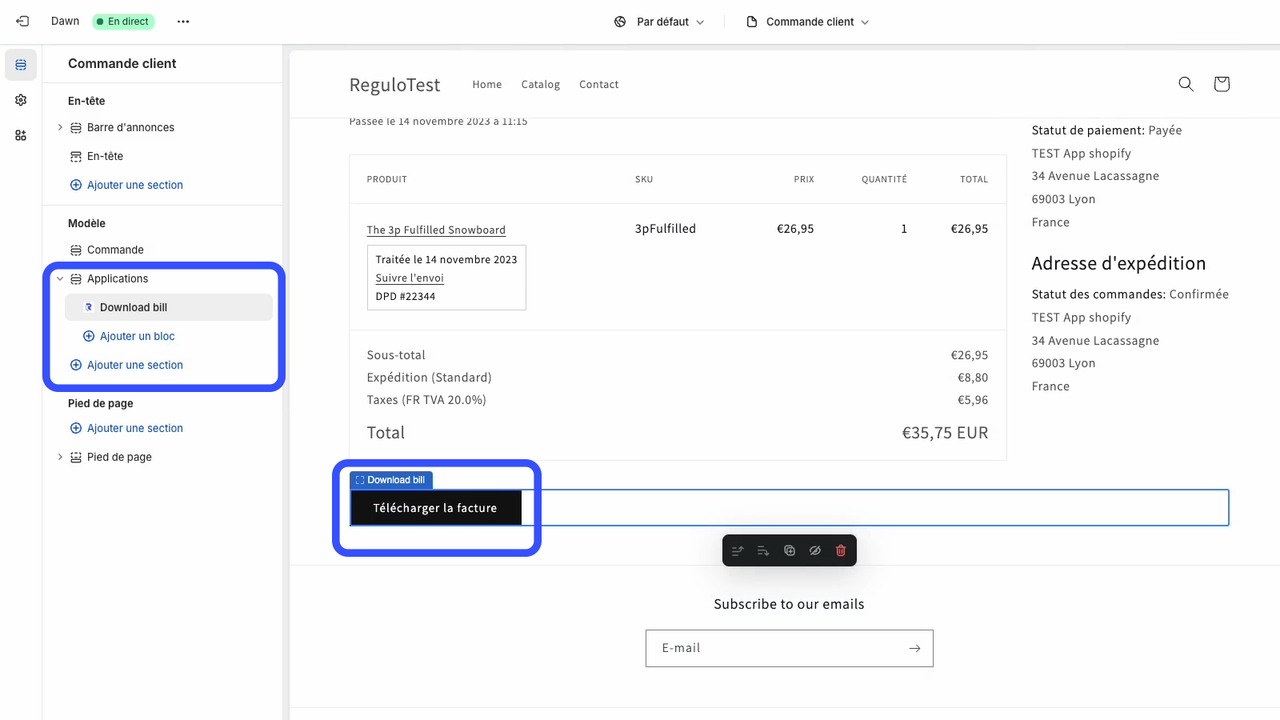

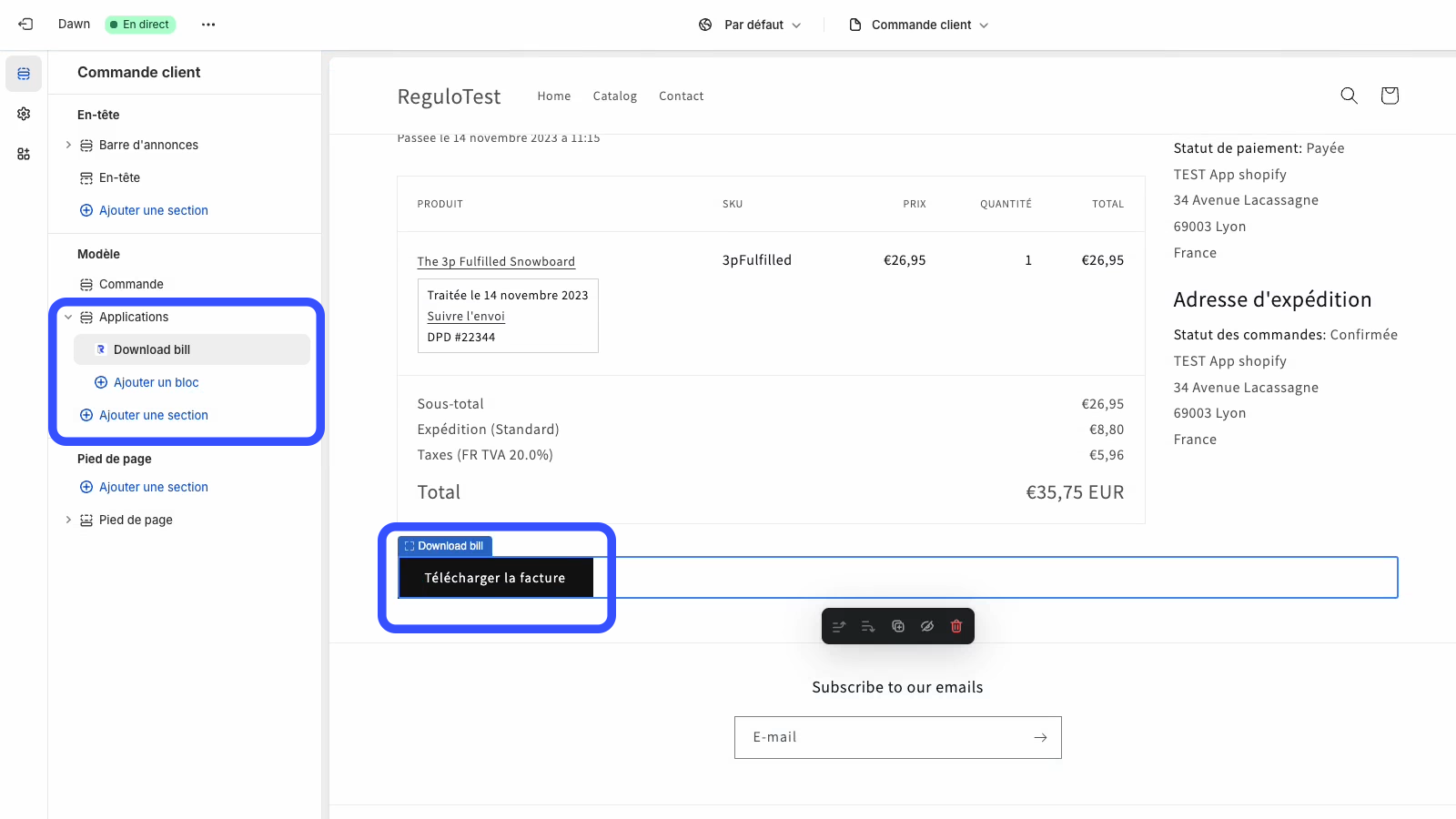

- Invoices available for the end customer in their customer account and/or via email

- Customizable multilingual invoices: logo, color, and special mentions

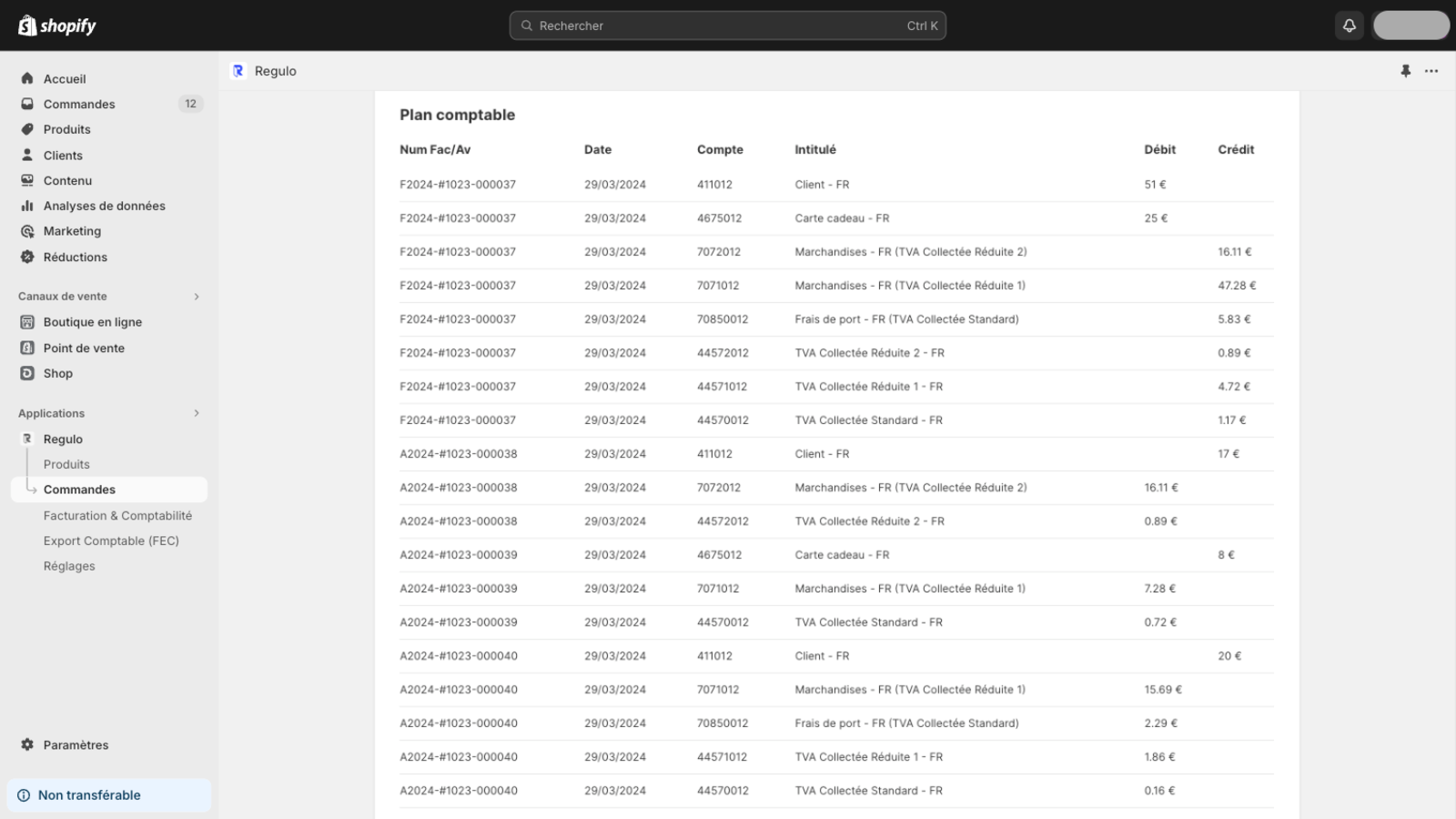

- Configurable accounting export in FEC format compatible with all accounting software

Merchant-Friendly

- European E-commerce Merchants

- Cross-border E-commerce Merchants

- B2B E-commerce Merchants

- Multilingual E-commerce Merchants

Basic Information

- Developer:Regulo

- Address:5, rue de la Claire, Arkanite, LYON, 69009, FR

- Price: Free / Free plan

- Rating:5 / 5

- Comment Count:16 comment

- Release Date:2024-4-3

- Supported languages:French

- Compatible products:Shopify

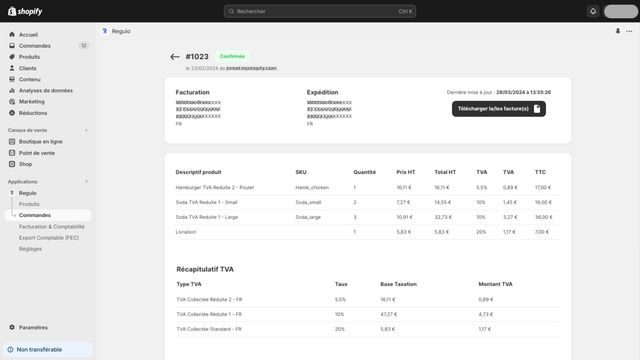

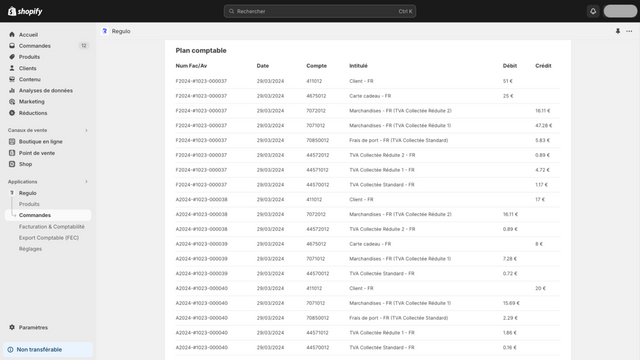

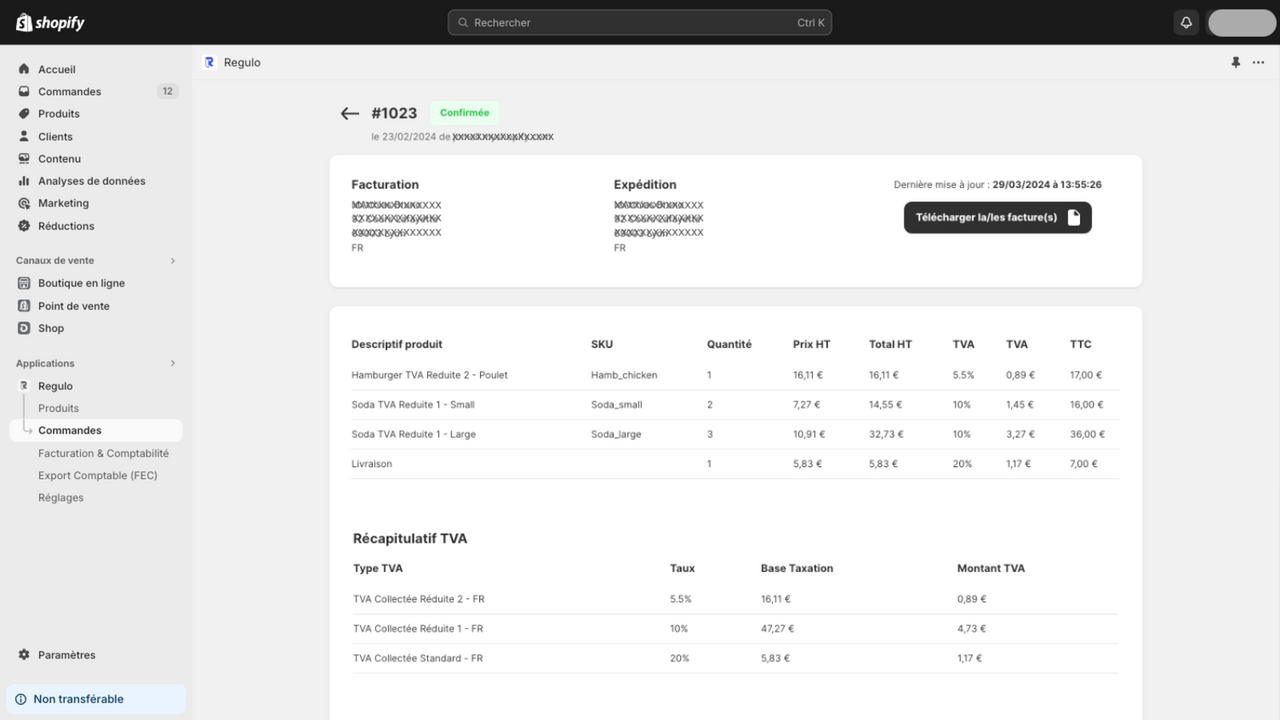

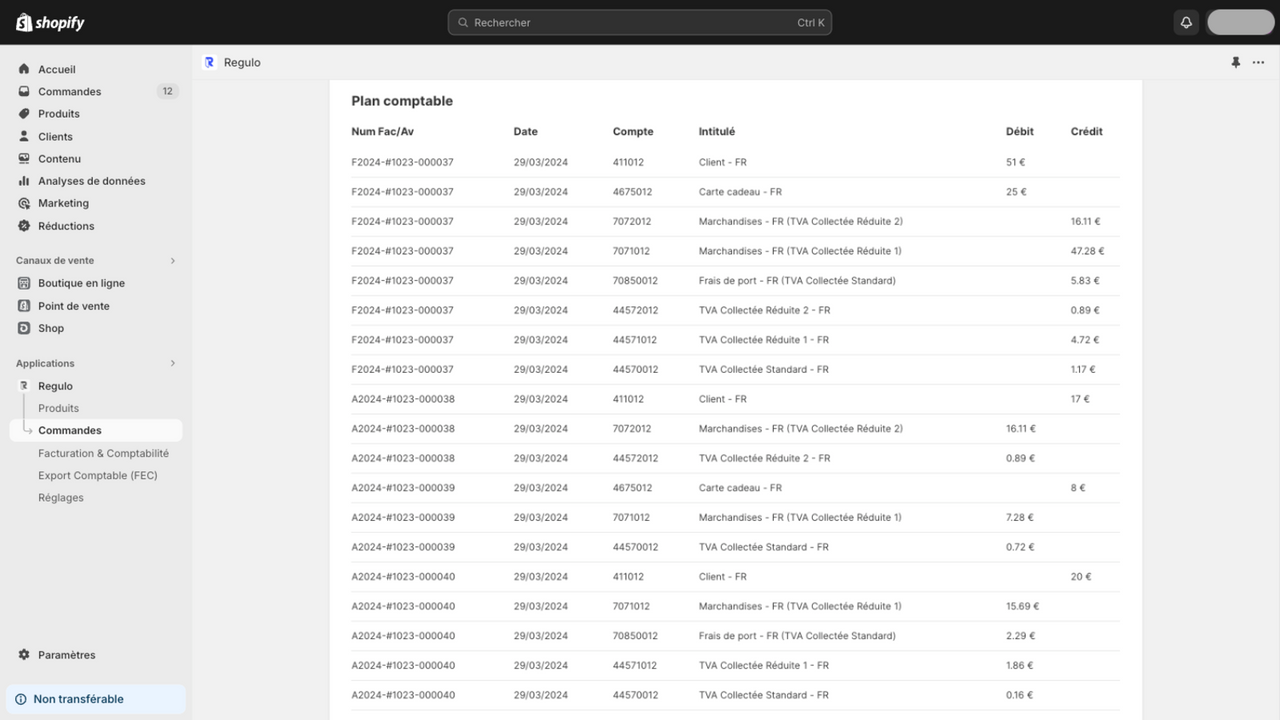

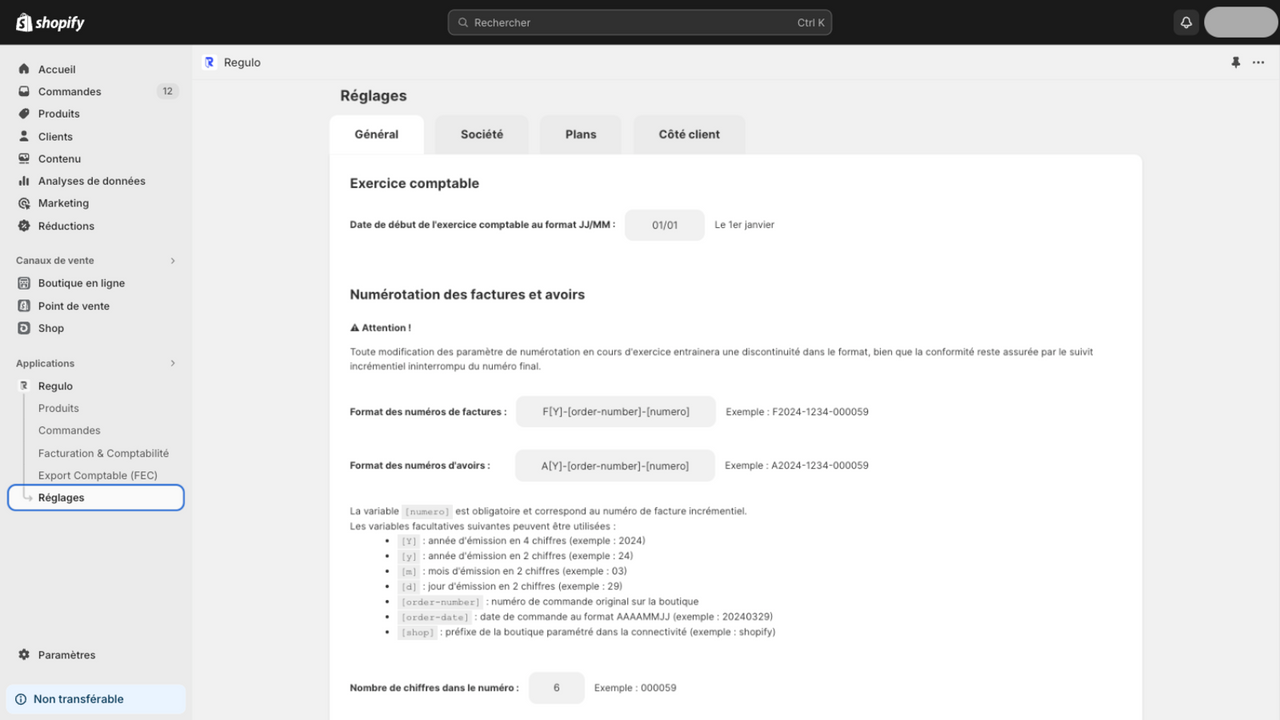

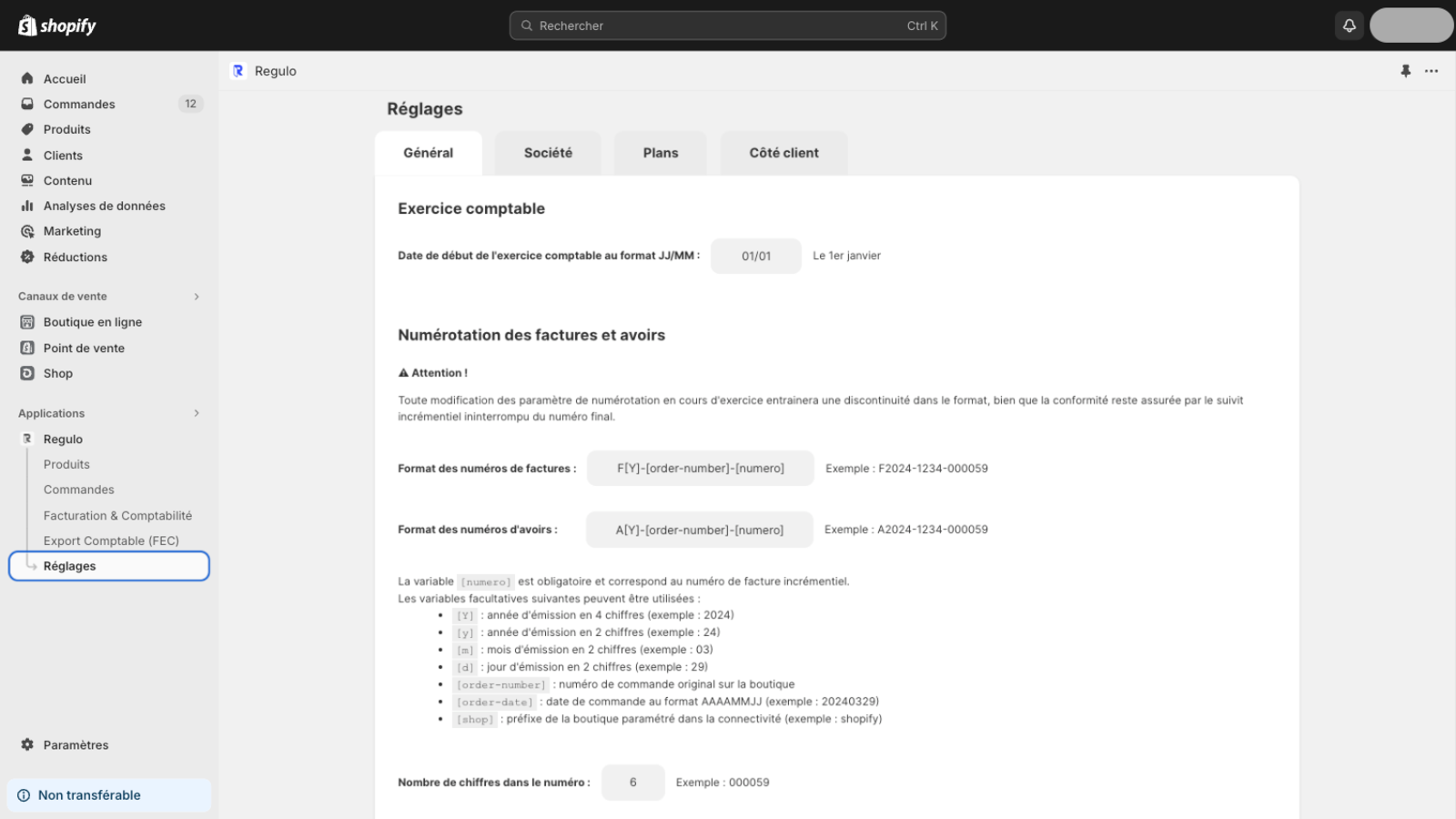

Application Screenshot

Price Plan

Découverte

- 100 invoices/credit notes per month

- Automated creation and sending (invoices/credit notes)

- Compliant with legislation

- Gift card / promo code supported

Essentiel

- 500 invoices/credit notes per month

- Discovery Plus Features:

- POS sales support

- Multilingual invoices (FR/EN/ES/PT/DE/IT)

- Standard Support

Professionnel

- 2000 invoices/credit notes per month

- Essential Plus Features:

- Advanced Dashboard

- Auto-VAT Liquidation for B2B

- Baback Returns Integration

- Priority Support

Avancé

- 10,000 invoices/credit notes per month

- Professional Plan features plus

- Customs compliance (HS code, country ...)

- Multiple VAT numbers (by country)

- Supplementary meta fields data on invoices

- Premium Support

User Location & Comments

User Location

Comments

Shopify API Used

- POST /admin/api/invoices.json

- GET /admin/api/invoices.json

- PUT /admin/api/invoices/{id}.json

Permission:write_invoices,read_invoices,manage_orders

- GET /admin/api/taxes.json

- PUT /admin/api/taxes/{id}.json

- POST /admin/api/taxes/rate.json

Permission:read_taxes,write_taxes,manage_taxes

- POST /admin/api/invoices/notify.json

- GET /admin/api/invoices/notify.json

- PUT /admin/api/invoices/notify/{id}.json

Permission:write_invoices,read_invoices,manage_customers

- POST /admin/api/invoices/language.json

- PUT /admin/api/invoices/language/{lang}.json

- GET /admin/api/invoices/language.json

Permission:write_invoices,read_invoices,manage_translations

- POST /admin/api/invoices/export.json

- GET /admin/api/invoices/export.json

- PUT /admin/api/invoices/export/{format}.json

Permission:read_invoices,manage_invoices,export_data