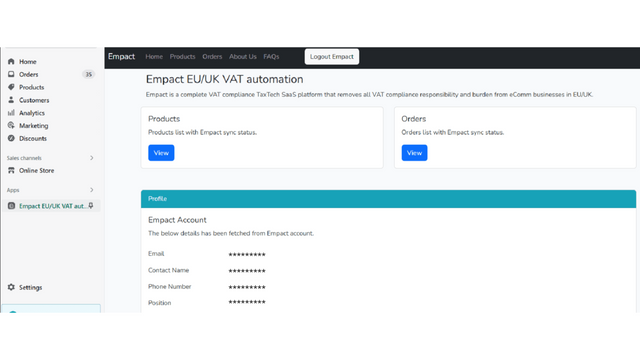

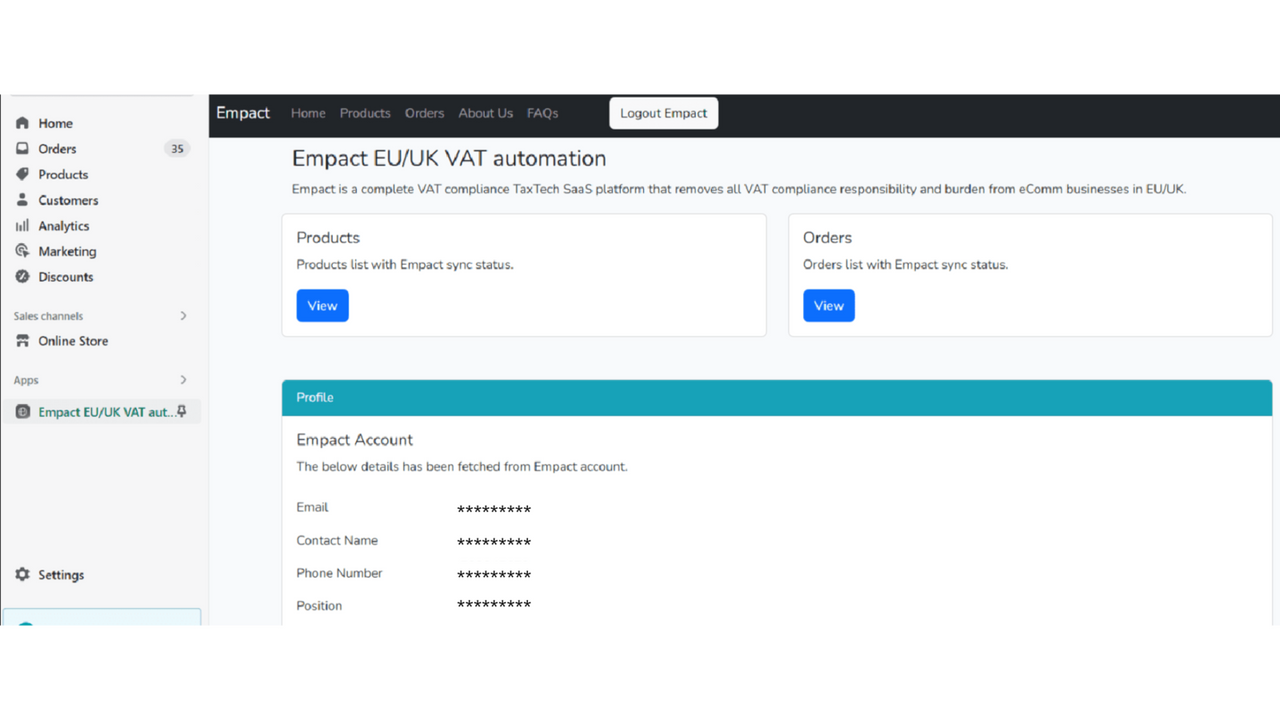

App Introduction

Empact relieves global e-commerce businesses of all VAT compliance obligations and burdens in the EU. Empact empowers sellers to focus on sales and core operations, starting with the VAT/IOSS/OSS number provided immediately after paid registration. Combined with our cloud-based system, which seamlessly integrates with Shopify and offers real-time transparency, Empact provides users with their own VAT number to ease the burden of new regulations. Meanwhile, each seller is eligible for a €10,000 threshold, with a maximum of €150 per individual sale.

Core Functionality

- Automatic VAT Reporting Tool - Save time, money, and avoid penalties.

- Console Service Shipping delivers the ultimate cross-border sales solution.

- B2B offline sales to the EU, eliminating the need to establish a local EU entity.

- B2C: Non-EU/UK sellers require IOSS, OSS, and local EU/UK VAT numbers for compliance.

- B2B: Non-EU/UK sellers require IOSS, OSS, and local EU/UK VAT numbers for compliance.

Merchant-Friendly

- Cross-border E-commerce Merchants

- EU Market Sellers

- B2B/B2C Integrated Merchants

- Compliance-required Merchants

- Non-EU Region Sellers

Basic Information

- Developer:empact

- Address:igal alon 65, tel aviv, 6744316, IL

- Price: Free / Free plan

- Rating:0 / 5

- Comment Count:0 comment

- Release Date:2023-6-7

- Supported languages:English

- Compatible products:Shopify

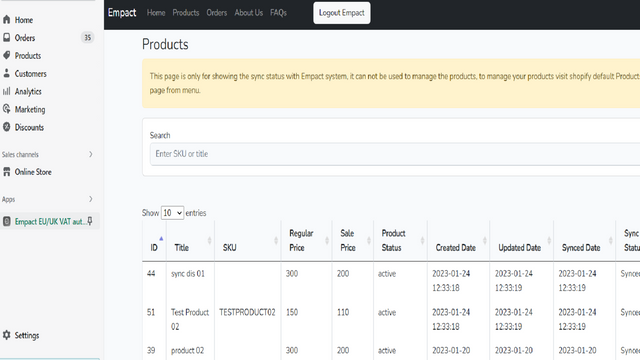

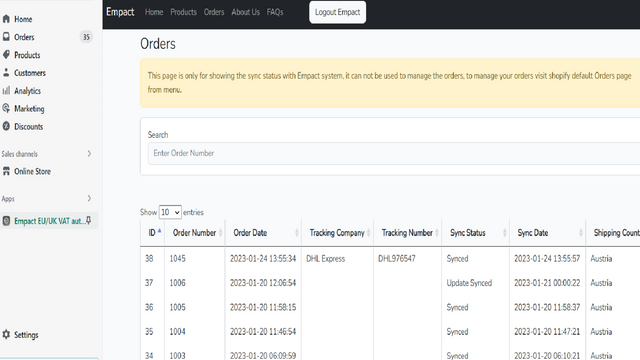

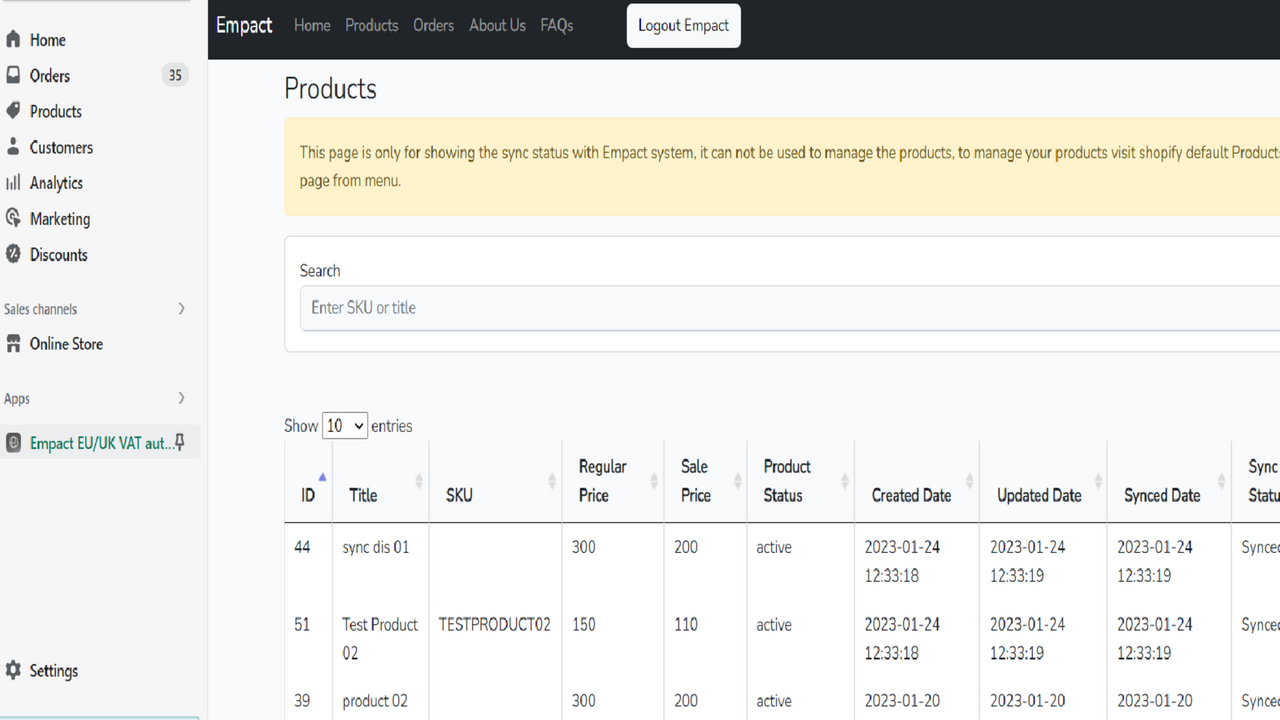

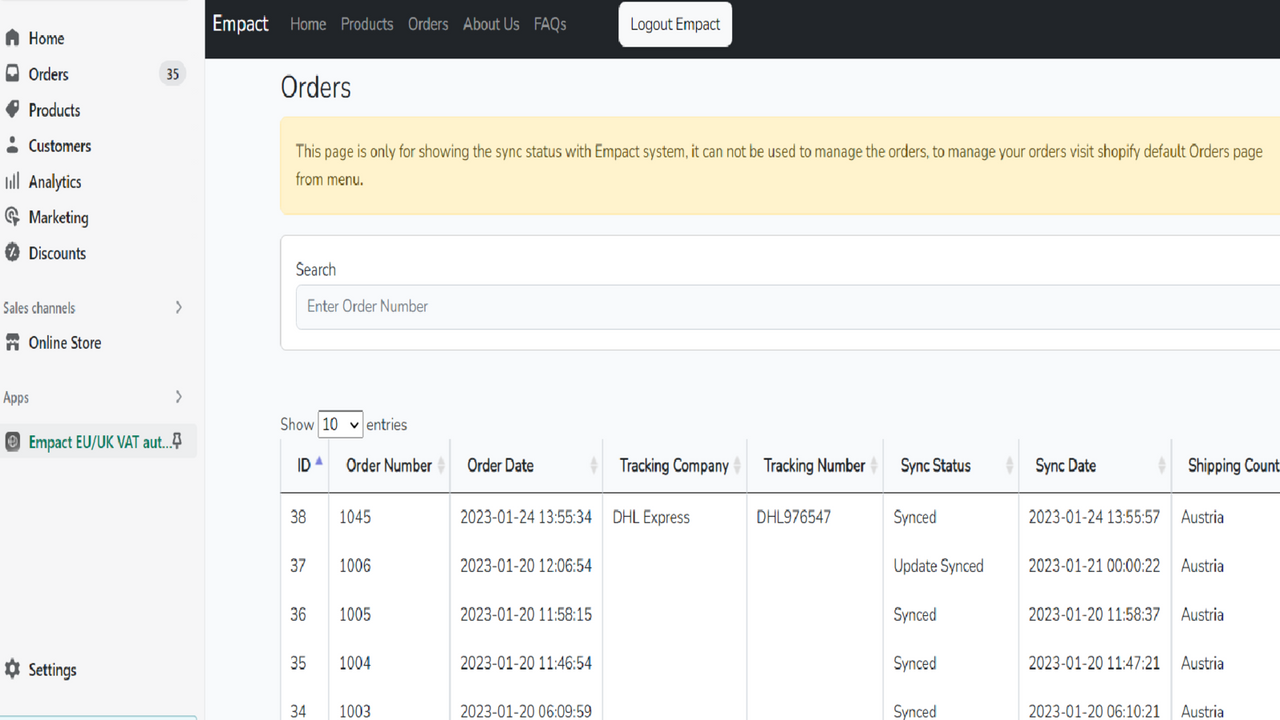

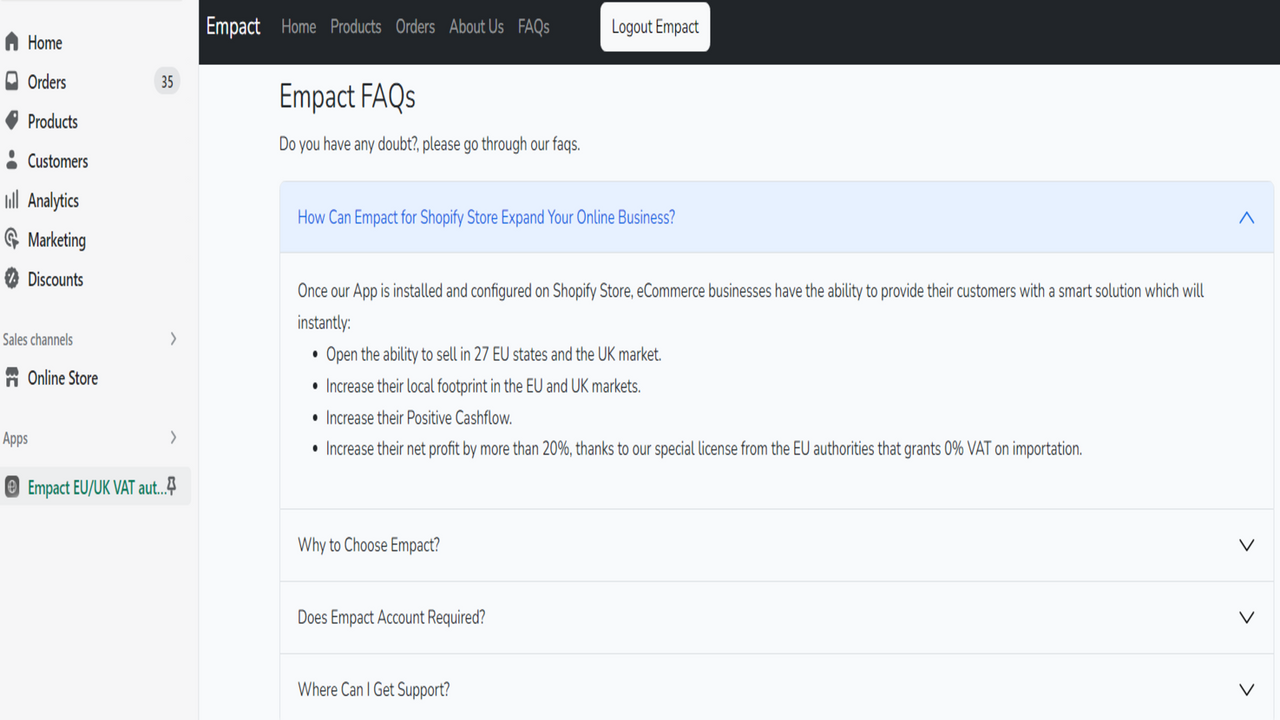

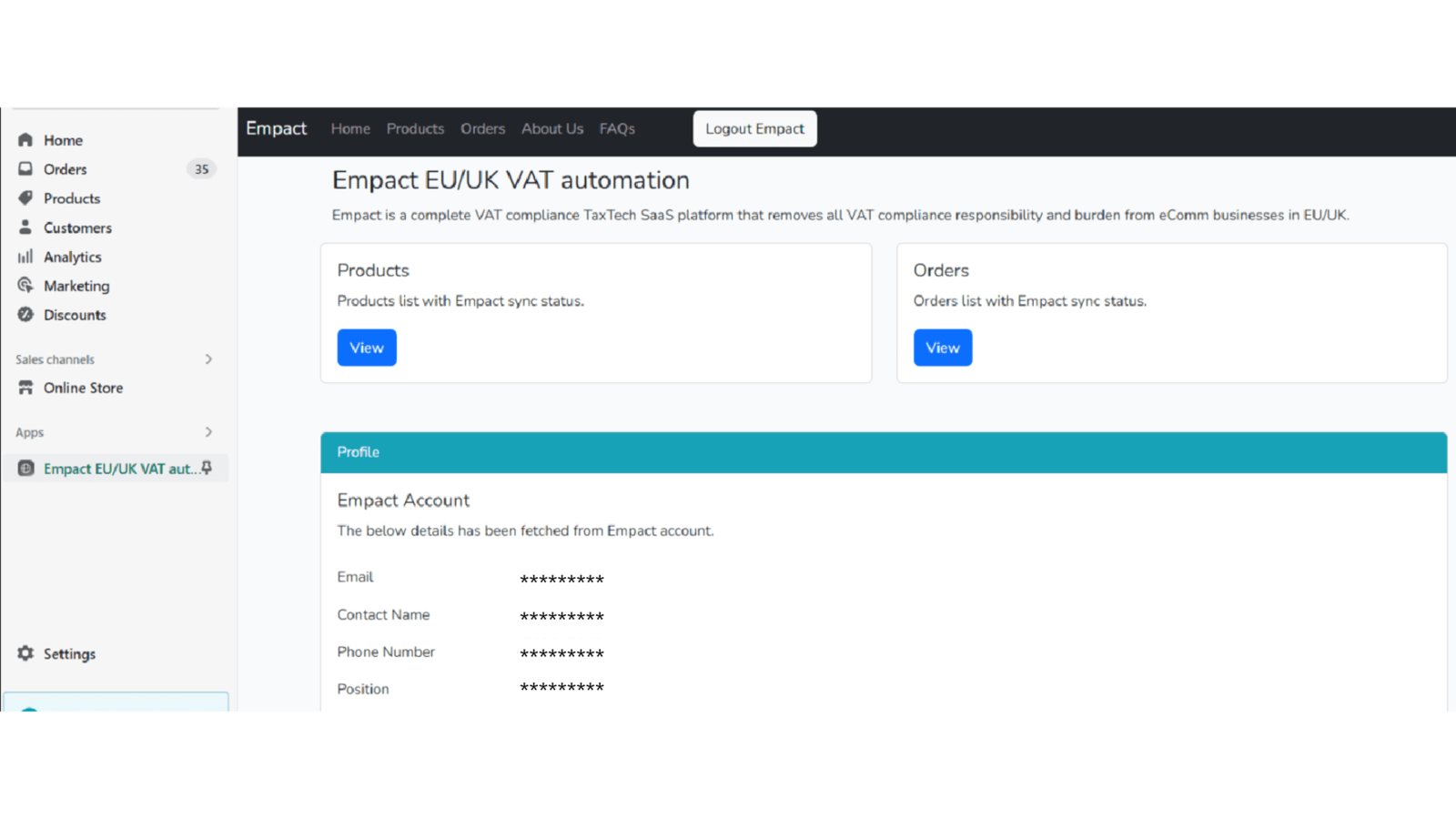

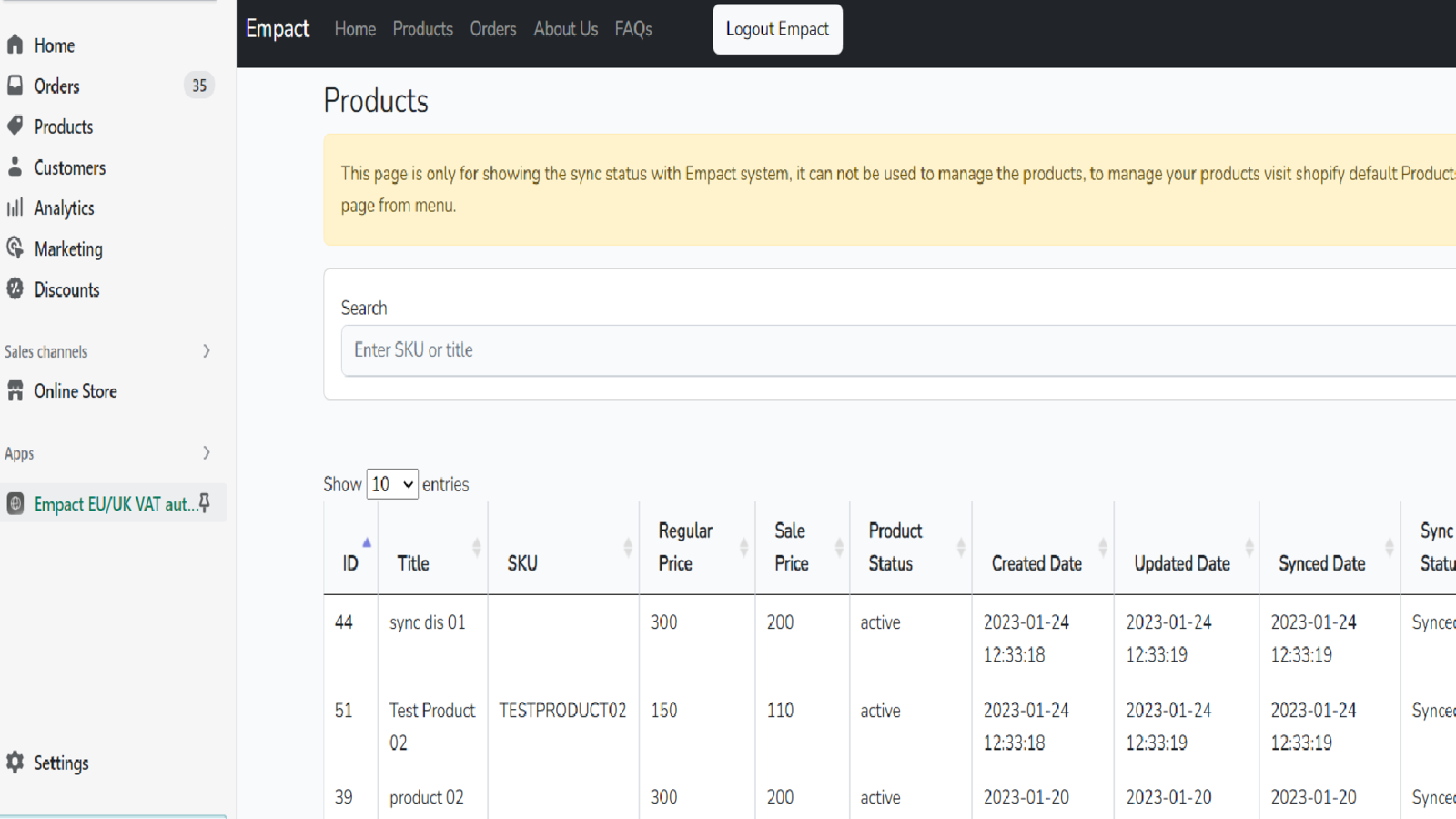

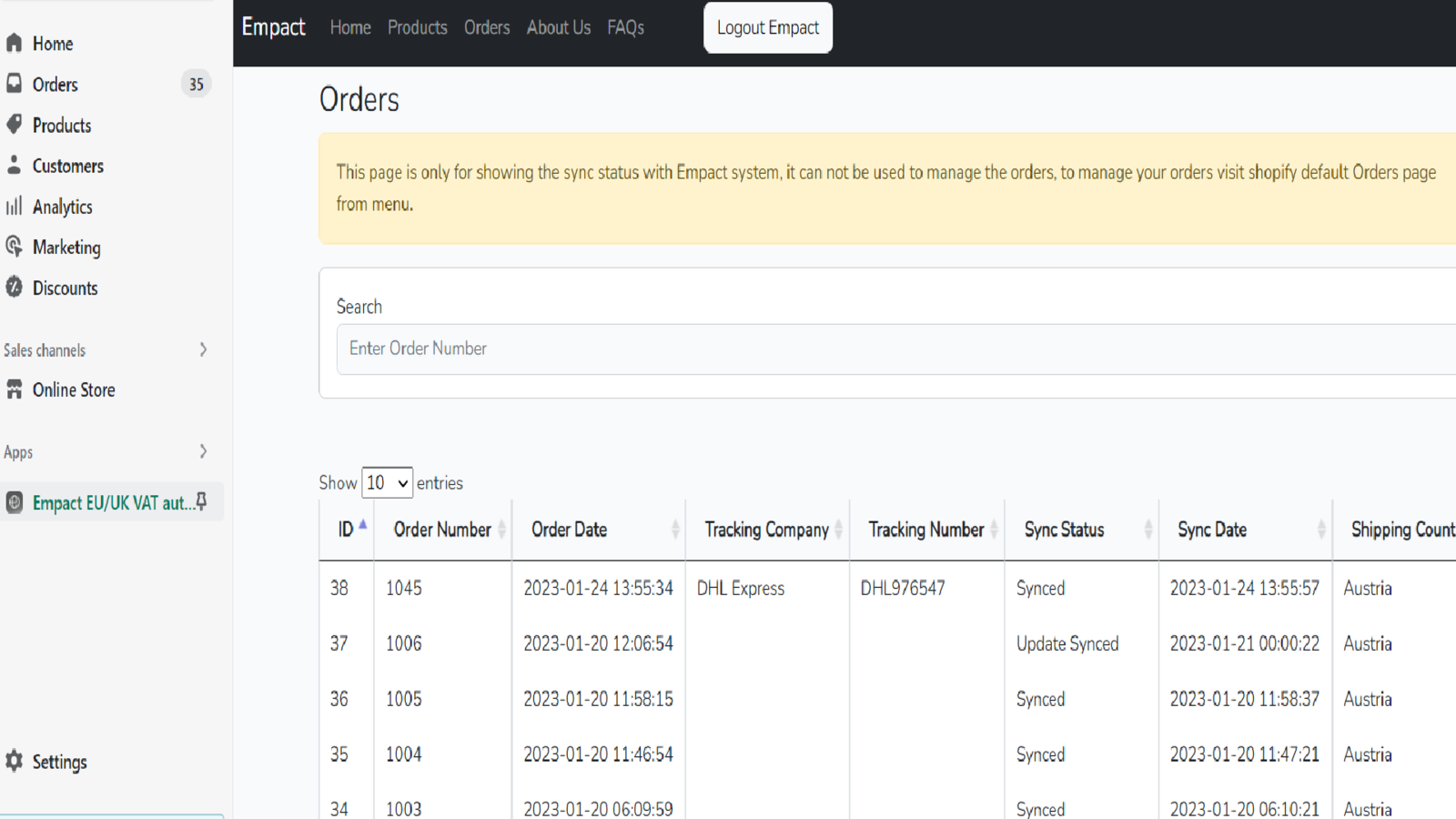

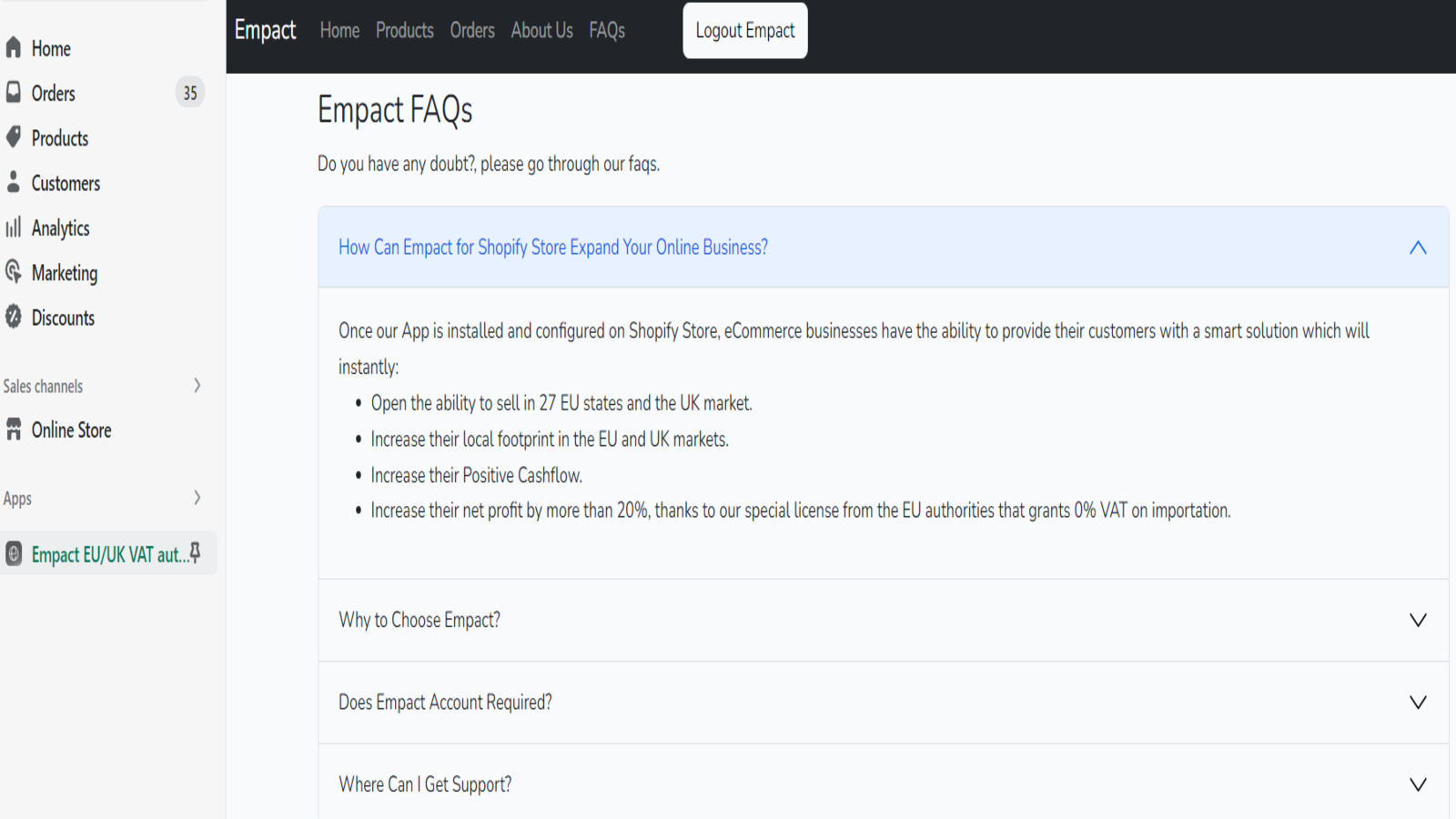

Application Screenshot

Price Plan

Free

User Location & Comments

User Location

Comments

Shopify API Used

- POST /admin/api/vat_reports.json

- GET /admin/api/vat_reports.json

- GET /admin/api/vat_reports/{id}.json

Permission:read_orders,read_finances,write_vat_reports

- POST /admin/api/shipping_console.json

- GET /admin/api/shipping_console.json

- PUT /admin/api/shipping_console/{id}.json

Permission:manage_shipping,read_orders,write_shipping_profiles

- POST /admin/api/b2b_offline_sales.json

- GET /admin/api/b2b_offline_sales.json

- PUT /admin/api/b2b_offline_sales/{id}.json

Permission:read_orders,manage_products,write_tax_settings

- POST /admin/api/vat_compliance/b2c.json

- GET /admin/api/vat_compliance/b2c.json

- PUT /admin/api/vat_compliance/b2c/{id}.json

Permission:read_orders,manage_tax,write_vat_settings

- POST /admin/api/vat_compliance/b2b.json

- GET /admin/api/vat_compliance/b2b.json

- PUT /admin/api/vat_compliance/b2b/{id}.json

Permission:read_orders,manage_tax,write_vat_settings